What’s on the minds of Venture Capital employees?

Venture capital (VC) is a powerful force that drives innovation, fuels entrepreneurship, and propels businesses to unprecedented heights. Behind the scenes, visionary investors armed with capital and expertise play a pivotal role in shaping our future. In this Rodller blog, we delve into the interesting world of venture capital, exploring its purpose, mechanics, and impact on the startup ecosystem.

1. Defining Venture Capital

Venture capital is a form of private equity investment that focuses on funding early-stage, high-potential companies with the aim of generating substantial returns. Unlike traditional financing methods, venture capitalists often take on significant risks, investing in unproven businesses or industries. They provide not only financial capital but also strategic guidance and industry connections.

2. The Role of Venture Capital

a) Catalyzing Innovation: Venture capital funds the dreams of entrepreneurs who dare to think differently, fostering a culture of innovation and pushing the boundaries of what’s possible.

b) Supporting Startups: VC firms act as mentors, guiding startups through the critical stages of growth, providing expertise, and helping them navigate challenges.

c) Portfolio Management: Venture capitalists assemble a portfolio of investments, spreading their risk across various companies, sectors, and stages of development.

d) Networking and Partnerships: VC firms bring together entrepreneurs, industry experts, and other investors, facilitating collaborations and knowledge sharing.

3. The Venture Capital Process

a) Sourcing: Venture capitalists actively seek promising startups through various channels such as referrals, pitch competitions, and industry conferences. It is in this area where Rodller adds a lot of value in Deal Sourcing.

b) Due Diligence: Rigorous research and analysis are conducted to assess the viability, market potential, and scalability of the startup. This involves scrutinizing the business model, team, financials, and market dynamics.

c) Investment: If the startup passes the due diligence process, the venture capitalist negotiates investment terms and provides the necessary capital in exchange for equity.

d) Value Addition: Venture capitalists provide more than just funding; they actively engage with the startup, offering strategic guidance, mentorship, and access to their network of industry contacts.

e) Exit Strategy: VC investors aim to realize returns on their investments through exit events like initial public offerings (IPOs), acquisitions, or secondary markmw-750et sales.

4. Impact on the Startup Ecosystem

a) Job Creation: Venture-backed startups often experience rapid growth, creating jobs and stimulating economic activity.

b) Technological Advancement: VC funding drives breakthrough technologies, fuels research and development, and accelerates the pace of innovation.

c) Economic Growth: Startups that receive venture capital funding contribute significantly to economic growth, generating tax revenues and attracting further investment.

d) Ripple Effect: The success of VC-backed startups inspires and motivates other entrepreneurs, leading to a multiplier effect within the startup ecosystem.

5. Challenges and Future Trends

a) Risk and Uncertainty: Venture capital is inherently risky, with a high potential for failure. However, successful investments can yield significant returns that outweigh the losses.

b) Diversity and Inclusion: The VC industry has been criticized for its lack of diversity, both in terms of gender and ethnicity. Efforts are being made to address these disparities and create a more inclusive ecosystem.

c) Emerging Sectors: Venture capitalists are increasingly focusing on emerging sectors such as artificial intelligence, blockchain, clean energy, and biotechnology, which offer immense growth potential.

d) Globalization: The venture capital landscape is becoming more globalized, with investors seeking opportunities beyond traditional tech hubs, expanding into emerging markets and supporting startups worldwide.

Venture capital plays a vital role in fuelling innovation, supporting entrepreneurship, and driving economic growth. By taking calculated risks and providing crucial resources, venture capitalists are catalysts for change, shaping the future of industries and transforming our world. As the startup ecosystem continues to evolve, the impact of venture capital will remain a powerful force, unlocking the potential of the brightest ideas and inspiring generations of entrepreneurs.

About Rodller

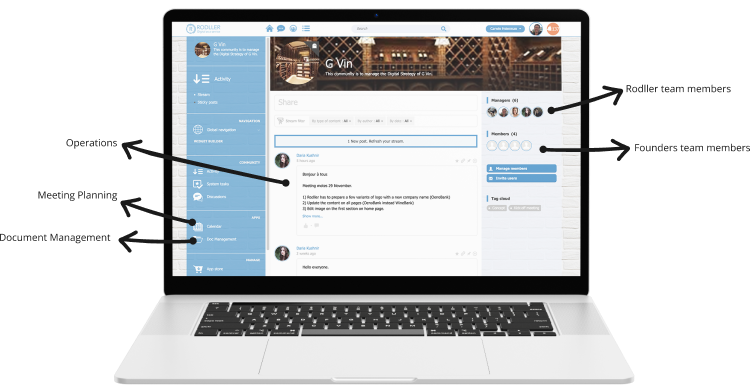

Rodller (www.rodller.com) provides Digital Marketing, Fundraising, and Application Development Services. With offices in Singapore and France, we serve both Startups and Fortune 2000 firms. We use a next-generation Portal to combine the use cases of Digital Marketing, Fundraising, and Application Development in tangible processes.

Leave a reply