Fundraising Down Under: Unique Features of Australian Fundraising

When raising capital in Australia, companies need to be aware of the distinct cultural norms, regulatory environment, and investor preferences that shape fundraising activities in this market. While many financing principles are universal, there are unique aspects to fundraising “Down Under” that require tailored strategies.

In this post, Rodller will explore the key features that make Australian fundraising unique across industries.

The Cultural Context

Australia has a pragmatic business culture that values straightforward communication and prudent risk management. This mindset extends to how investors evaluate fundraising opportunities. Australian investors tend to be more conservative and risk-averse compared to markets like Silicon Valley.

They often prioritize profitability, cash flow management, and proven business models over-ambitious growth projections or unproven technologies. Building trust through transparent financials, clear go-to-market strategies, and realistic forecasting is crucial for successful fundraising.

At the same time, Australians respect innovation and are open to disruptive business ideas that solve real problems. However, companies need to clearly articulate their competitive advantages, intellectual property protection strategies, and exit prospects to pique investor interest.

The Regulatory Landscape

Australia has a robust regulatory framework governing capital-raising activities across various industries. The key regulator is the Australian Securities and Investments Commission (ASIC), which enforces the Corporations Act and other relevant legislation.

Depending on the fundraising method and investor type, companies may need to comply with public offering disclosure requirements, investment prospectus rules, or specific exemptions for private placements. The regulations aim to protect investors and promote market integrity but can create complexity for companies navigating the fundraising process.

For example, public equity crowdfunding campaigns require extensive disclosure documents and compliance with stringent advertising restrictions. Private capital raises involving sophisticated or professional investors have more streamlined requirements but strict criteria for investor qualification.

Understanding and adhering to this regulatory landscape is essential to avoid potential penalties, investor disputes, or reputational damage. Many companies engage legal counsel or corporate advisory firms to ensure full compliance throughout the fundraising process.

Venture Capital and Angel Investment

Australia has a growing but relatively modest venture capital (VC) ecosystem compared to major global startup hubs. However, the local VC landscape is maturing, with increasing capital inflows and a growing number of experienced investors.

Successful VC fundraising in Australia often hinges on building relationships and leveraging personal networks. Australian VCs place significant emphasis on the founding team’s track record, domain expertise, and ability to execute. Compelling traction metrics, a clear path to profitability, and a well-articulated exit strategy are also critical.

Angel investors play a vital role in early-stage funding, frequently providing the first institutional capital for startups. Australian angel groups are often industry-specific, allowing investors to leverage their sector knowledge and connections. Building a strong advisory network and gaining social proof through reputable angel backers can significantly boost fundraising prospects.

Corporate Venture Capital and Strategic Investors

Large Australian corporations across various sectors have established corporate venture capital (CVC) arms to gain exposure to innovative technologies and potential acquisition targets. Securing CVC investment can provide startups with valuable industry expertise, access to distribution channels, and potential exit opportunities through acquisition.

Successful fundraising from CVCs often involves aligning the startup’s solution with the corporate investor’s strategic priorities, such as addressing specific operational challenges or enabling new revenue streams. Demonstrating a clear understanding of the corporate partner’s business model and articulating the potential synergies is crucial.

Strategic investors, such as industry incumbents or major suppliers, can also be valuable sources of capital and operational support. However, companies need to carefully manage potential conflicts of interest and ensure their fundraising strategies align with their long-term objectives.

Private Equity and Family Offices

Australia has a well-established private equity industry that can provide growth capital for mid-market and mature companies across various sectors. Private equity fundraising typically involves extensive due diligence processes, rigorous financial modelling, and a strong emphasis on operational improvements and value-creation strategies.

Successful private equity fundraising often requires companies to demonstrate strong cash flow generation, defensible market positions, and clear growth prospects through strategic acquisitions, geographic expansion, or operational optimizations.

Family offices, which manage the wealth and investments of high-net-worth individuals or families, are also active investors in Australian companies. These investors often prioritize long-term stability, sustainable business models, and alignment with their values and investment philosophies. Building personal relationships and trust is crucial when fundraising from family offices.

Public Markets and IPOs

For established companies seeking larger capital infusions, the Australian public markets offer various fundraising options, including initial public offerings (IPOs) and secondary equity raises.

The Australian Securities Exchange (ASX) is the primary stock exchange, with listing requirements and regulations tailored to different company sizes and industries. Successful public market fundraising often involves extensive pre-marketing efforts, robust financial reporting and governance structures, and compelling equity stories that resonate with institutional and retail investors.

Companies pursuing an IPO must navigate stringent disclosure requirements, regulatory approvals, and potentially heightened public scrutiny. Engaging reputable investment banks, legal advisors, and investor relations specialists is essential to navigate the complexities of the public listing process.

Alternative Financing Options

Beyond traditional equity fundraising, Australian companies also have access to various alternative financing options, such as debt financing, revenue-based financing, and crowdfunding platforms.

Debt financing, including bank loans and corporate bonds, can provide capital for growth initiatives, acquisitions, or working capital needs. However, companies must demonstrate strong credit profiles, collateral assets, and sustainable cash flow projections to secure favourable terms.

Revenue-based financing has gained traction, particularly for recurring revenue businesses, allowing companies to access upfront capital in exchange for a percentage of future revenues. This option can be attractive for companies seeking non-dilutive funding but requires careful consideration of the long-term implications on cash flow and profitability.

Equity crowdfunding platforms have also emerged as alternative fundraising channels, enabling companies to raise capital from a broader pool of investors. However, these platforms often have investment caps, and heightened disclosure requirements, and may cater to specific industries or investor types.

Looking Ahead

As the Australian business landscape continues to evolve, companies seeking capital will need to adapt their fundraising strategies to address emerging trends and investor preferences. Factors such as the rise of impact investing, increasing emphasis on environmental, social, and governance (ESG) factors, and the growing influence of retail investors will shape the future of fundraising Down Under.

As Rodller collaborates with Australian companies, we can stand that by understanding and embracing the unique cultural nuances, regulatory complexities, and investor mindsets that characterize the Australian market, companies can position themselves for fundraising success. Building robust financial foundations, articulating compelling value propositions, and cultivating trust through transparency will be essential across all sectors and funding stages.

Fundraising in Australia presents its challenges, but by recognizing and capitalizing on these distinct market features, companies can unlock the capital they need to drive growth, innovation, and long-term value creation.

About Rodller

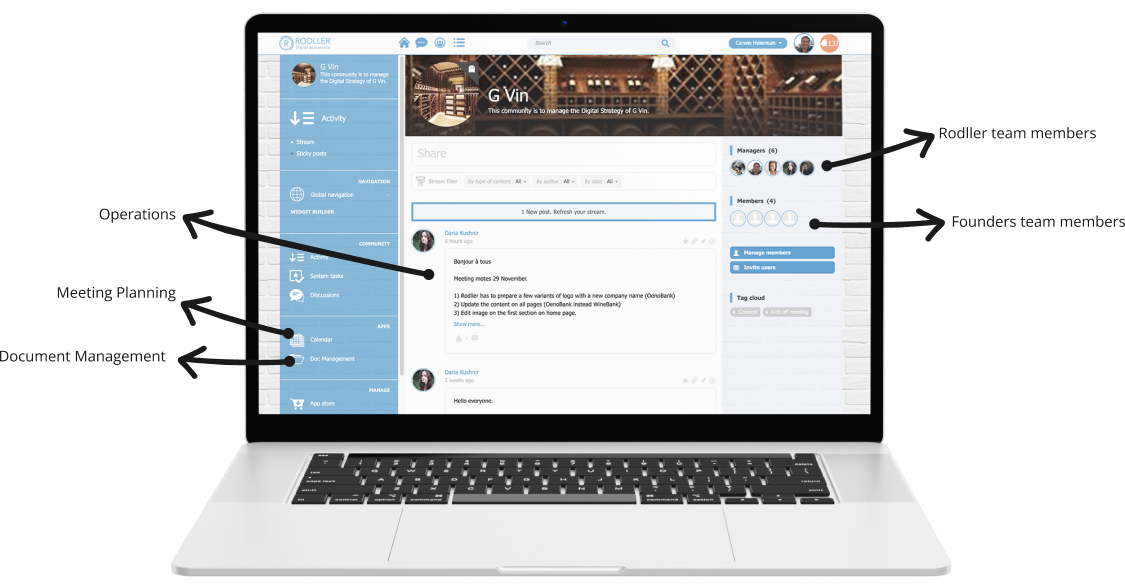

Rodller (www.rodller.com) provides Digital Marketing, Fundraising and Application Development Services. With offices in Singapore and France we serve both Startups and Fortune 2000 firms. We use a next generation Portal to combine the use cases of Digital Marketing, Fundraising and Application Development in tangible processes.

Leave a reply