A Guide to Successfully Raising Seed Funding for Your Startup

Starting your new business is an exciting journey filled with countless possibilities and challenges. One of the biggest hurdles entrepreneurs face is securing the necessary capital to transform your ideas into reality. Seed funding, often obtained during the early stages, can provide the financial support needed to kick-start your startup and set it on a path to success. In this Rodller blog post, we will explore the key steps and strategies involved in raising seed funding for your startup.

1. Develop a compelling business plan

A well-crafted business plan serves as the foundation for securing seed funding. It should outline your startup’s vision, mission, target market, competitive advantage, and revenue model. Investors want to see a clear understanding of your business’s potential and how you plan to monetize it. Make sure your plan demonstrates scalability and addresses potential risks and challenges.

2. Build a strong network

Networking is crucial for entrepreneurs seeking seed funding. Attend industry events, join startup communities, and engage with potential investors. Seek out mentors, advisors, and fellow entrepreneurs who can offer guidance and introductions to investors. Building strong relationships in the startup ecosystem enhances your credibility and increases your chances of finding the right investors for your business. Rodller can add value by exposing your Business Plan to hundreds of Investors.

3. Identify the right investors

It’s important to identify investors who align with your startup’s industry, stage, and vision. Research venture capital firms, angel investors, and crowdfunding platforms that specialize in your sector. Look for investors who have a track record of supporting similar ventures and understand the challenges specific to your industry. Targeting the right investors increases the likelihood of securing funding and accessing valuable expertise. Rodller uses the Mandate driven tech for this.

4. Craft a compelling pitch

Your pitch should succinctly communicate your startup’s value proposition, market opportunity, and growth potential. Develop a compelling narrative that captures investors’ attention and showcases your passion and expertise. Be prepared to explain how the seed funding will be utilized, what milestones it will help you achieve, and how it will provide a return on investment for the investors.

5. Create a captivating investor deck

At Rodller we believe the Investment Deck quality is critical in the entire Process. Your investment deck is used to present your company’s potential as an investment opportunity. It should include detailed information about the company, including its financials, market analysis, competitive landscape, and growth strategy. It is used to convince potential investors of the company’s potential. Rodller has designed a unique template that will enforce the way your Business is presented. It will also help Founders to present the numbers in a pragmatic and easy to understand manner.

6. Demonstrate traction and proof of concept

While early-stage startups may not have significant revenue, it’s crucial to demonstrate traction and proof of concept to potential investors. Showcase any customer feedback, pilot projects, partnerships, or initial sales that validate your business model. Investors want to see evidence that your startup has the potential to gain market acceptance and generate returns on their investment.

7. Leverage online platforms

Utilize online platforms and crowdfunding websites to raise seed funding. Platforms like Rodller, provide access to a wide pool of investors interested in early-stage ventures. Negotiate terms wisely:

When negotiating with investors, consider the terms of the funding carefully. Understand the implications of equity, valuation, board seats, and control rights. Seek legal advice to ensure you fully comprehend the terms and negotiate a fair agreement that aligns with your long-term goals. Striking the right balance between securing funding and maintaining control over your startup is essential.

Raising seed funding is a critical step in transforming your startup idea into a thriving business. By developing a compelling business plan, building a strong network, targeting the right investors, crafting an engaging pitch, and leveraging online platforms, you increase your chances of securing the financial support needed

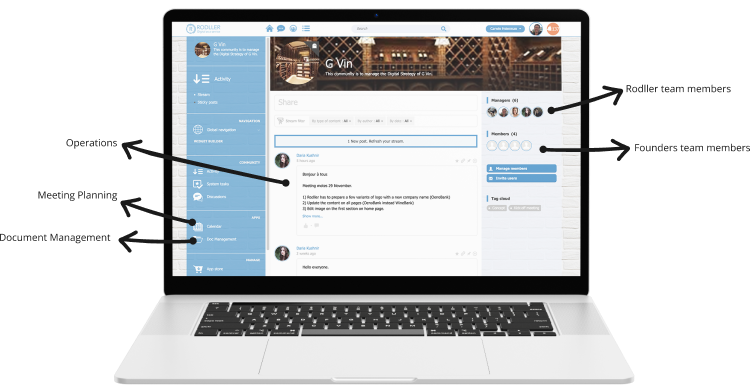

About Rodller

Rodller (www.rodller.com) provides Digital Marketing, Fundraising, and Application Development Services. With offices in Singapore and France, we serve both Startups and Fortune 2000 firms. We use a next-generation Portal to combine the use cases of Digital Marketing, Fundraising, and Application Development in tangible processes.

Leave a reply